Watch out for any "chance" that requests an upfront charge, wants you to pay for certification, or demands your Social Security number or any monetary details, such as your credit card number. Still not sure if a chance is legitimate? Try to find community forums, like those on Reddit, for unfiltered evaluations and problems.

There are a lot of ways you can make your money work for you. With the ideal systems, you can save and invest for your future. Doing so will develop a solid foundation for your individual finances. I'm going to show you the 6 best cash tips that can help you pay off your financial obligation, invest and grow your cash, and save for something enjoyable like a holiday this year.

These 6 money ideas are going to leverage something I like to call Time Maker Investing. No, I don't have a flying Delorean however I do have more than a years of mentor people about personal financial resources. Hop in, and leave your budget behind. Where we're going, we don't need spending plans. how much money can youa ctually make in finance.

Your money can just work for you once you run out debt. After all, you can't correctly invest in yourself or your future if you have a mountain of that you haven't resolved yet. We do not come out of the womb understanding how credit cards work. There's no "Settling your loans 101" class in high school - how much money do consumer finance people make.

In fact, they're in business to keep you in debt for as long as possible so THEY can make money. Thankfully, there are steps you can take to get out of debt no matter just how much you owe. I composed an article detailing precisely. Here are the crucial insights from that article: that lots of don't in fact know just how much debt they owe.

How Much Money Can A Physicist Make In Finance - The Facts

Just then can you begin a good strategy to eliminate it. Dave Ramsey notoriously promotes his Snowball Approach of leaving debt. This includes paying the minimums on all of your debt, but paying more cash to the card with the least expensive balance first (i.e., the one that will enable you to pay it off the quickest).

You can negotiate a lower interest rate and put the cash you save toward cracking away at what you owe. You can likewise take advantage of to maximize some cash. If you're truly resourceful, though, you can start MAKING more money. First step: Go through your account statements,, do whatever it takes to learn just how much you owe on these bills.

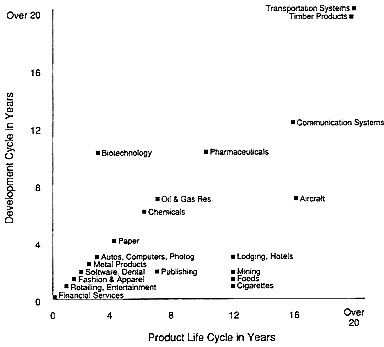

The chart appears like this: Just How Much DO YOU OWE? Call of Charge Card Overall Quantity of Debt APR Monthly Minimum Payment It'll help you learn how much you owe to each business and what your interest rates are. You can likewise use my free online tool. Stop right now and do this.

If your total debt number seems high, keep in mind two things: There is a large group of individuals with more financial obligation than you. From this day that number is only going to go down. This is the start of the end. If you need assistance getting out of debt, examine out my outright finest resources on getting out of debt below: PERKS: For even more systems on eliminating your financial obligation, have a look at my 3-minute video below on how to negotiate your debt.

Examine out my Ultimate Guide to Personal Finance for ideas you can carry out TODAY. A 401k permits you to invest money for retirement AND receive free cash from your employer while doing so. Here's how it works: Each month, a portion of your pre-tax pay is invested automatically into the 401k.

Getting The How To Make Money Blogging On Finance To Work

You aren't taxed on your profits until you withdraw it at retirement age (59 years of ages). This suggests that you'll make more with compounding over your lifetime. Imagine you make $100,000/ year and your company uses you a 3% match on your 401k. If you invest $3,000 (3% of $100,000), your business will match you that much in your 401k.

In 2019 the contribution limit for a 401k is $19,000. Maxing it out is an incredible objective to have. Make certain to take advantage of your company's 401k strategy by putting a minimum of enough money to collect the employer match into it. This guarantees you're making the most of what is basically totally free cash from your employer.

If you're fretted about your individual finances, you can improve them without even leaving your couch. Have a look at my Ultimate Guide to Personal Finance for ideas you can execute TODAY. This is another tax-advantaged retirement account that allows for extraordinary development and cost savings. Unlike your 401k, though, this account leverages after-tax earnings.

INCREDIBLE. Like your 401k, you're going to want to max it out as much as possible. The amount you are permitted to contribute goes up periodically. As of 2019, you can contribute as much as $6,000/ year. I recommend putting cash into an index fund such as the S&P 500 along with an international index fund also.

: If you do not know where to find the cash to buy https://www.businesswire.com/news/home/20190806005798/en/Wesley-Financial-Group-6-Million-Timeshare-Debt these accounts, find out how you can save a lot of money with. If you're stressed over your personal financial resources, you can improve them without even leaving your sofa. Have a look at my Ultimate Guide to Personal Finance for tips you can execute TODAY.

Fascination About Do Auto Dealers Make More Money When You Buy Cash Or Finance

The 2nd best time is today. I understand, I understand. I sound like a tacky inspirational poster but the adage is true. If you wish to buy a house or a nice vehicle one day, you do not wish to believe about where you're going to get the cash the day you prepare to purchase it.

That's why I'm a HUGE proponent of. There are still people out there who have actually heard me harp on this for actual YEARS and still haven't automated their finances. And why western time share not? For a couple of hours of work, you can save yourself countless dollars down the road. One reason many are averse how much does wesley financial cost to conserving money is due to the discomfort of putting our hard-earned cash into our cost savings accounts each month.

It's a set-it-and-forget-it method to your financial resources, enabling you to send all of your money precisely where you require it to go as soon as you get your paycheck. After all, if you needed to track your spending and move money into cost savings monthly, it would become one of those "I'll get to that later" things and you 'd NEVER EVER get to it.

That's why. You can start to dominate your finances by having your system passively do the ideal thing for you. Instead of considering conserving every day set it and forget it. To do this, you need just one hour today to set everything up so your paycheck is divided into four major containers as quickly as it gets here in your monitoring account.